Medicare Advantage Agent - The Facts

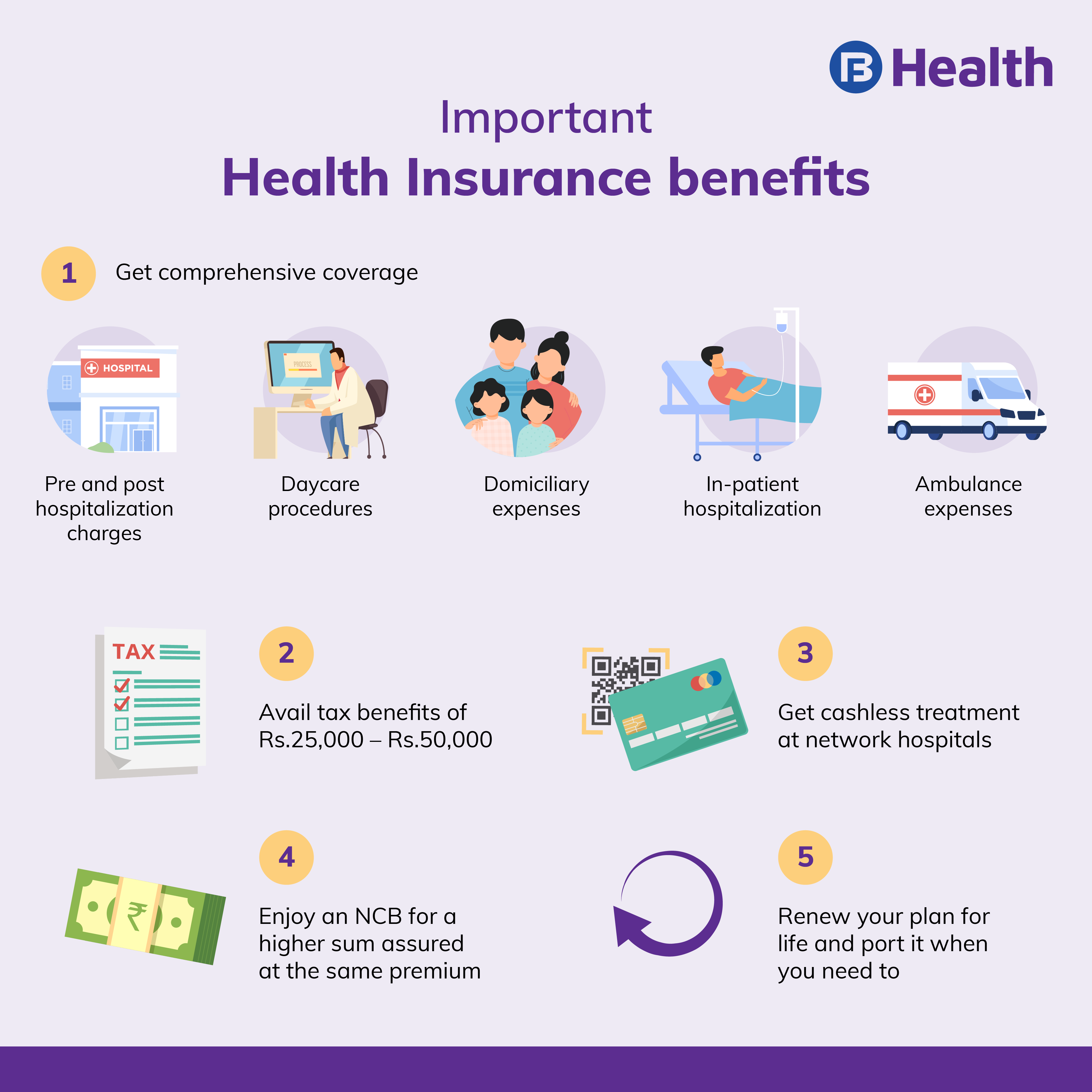

Having health insurance has many advantages. It protects you and your family from economic losses similarly that home or automobile insurance coverage does. Even if you remain in great wellness, you never know when you may have an accident or get sick. A trip to the healthcare facility can be a lot more pricey than you may anticipate.

Average prices for giving birth depend on $8,800, and well over $10,000 for C-section shipment. 1,2 The complete cost of a hip replacement can run a whopping $32,000. These examples sound frightening, but the bright side is that, with the ideal plan, you can safeguard yourself from many of these and other kinds of clinical bills.

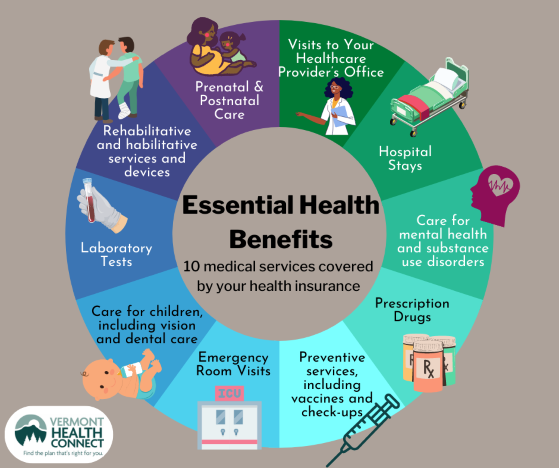

With a health insurance strategy, you help secure the health and wellness and financial future of you and your household for a lifetime. Medicare Advantage Agent. With the brand-new means to get affordable medical insurance, it makes good sense to obtain covered. Various other crucial advantages of medical insurance are accessibility to a network of doctors and hospitals, and various other resources to help you remain healthy and balanced

The 9-Minute Rule for Medicare Advantage Agent

Today, roughly 90 percent of U.S. homeowners have wellness insurance with considerable gains in wellness protection happening over the past 5 years. Medical insurance assists in access to care and is connected with lower fatality rates, better wellness outcomes, and improved performance. Regardless of recent gains, even more than 28 million people still lack insurance coverage, putting their physical, psychological, and monetary health and wellness in jeopardy.

Specifically, recent studies that reviewed changes in states that expanded Medicaid contrasted to those that really did not highlight the value of insurance coverage. Grown-up Medicaid enrollees are five times most likely to have regular resources of care and 4 times more probable to get preventative treatment solutions than individuals without insurance coverage.

Rumored Buzz on Medicare Advantage Agent

Individuals in Medicaid development states have greater rates of diabetes diagnoses than those in states that did not expand. They get much more timely, and therefore less difficult, take care of 5 typical surgical conditions. Medicaid expansion is related to access to timely cancer cells medical diagnoses and treatment.11,12,13,14,15 Protection enhancesaccessibilityto behavioral wellness and compound make use of disorder therapy. By 2016, 75 %of Medicaid enrollees with OUD filled prescriptions for drug therapy. Protection decreases price barriers to accessing treatment. Fewer people in states that broadened Medicaid report cost as a barrier to care than those in states that did not increase Medicaid, and fewer people in growth site here states report skipping their medicines as a result of price. As an example, Hispanics have overmuch high rates of being.

uninsured, as contrasted to non-Hispanic whites. The high rate of uninsured puts stress on the more comprehensive healthcare system. Individuals without insurance put off required care and depend more greatly on hospital emergency departments, resulting in scarce sources being directed to treat problems that usually can have been stopped or handled in a lower-cost setup. While all providers offer some degree of charity care, it wants to.

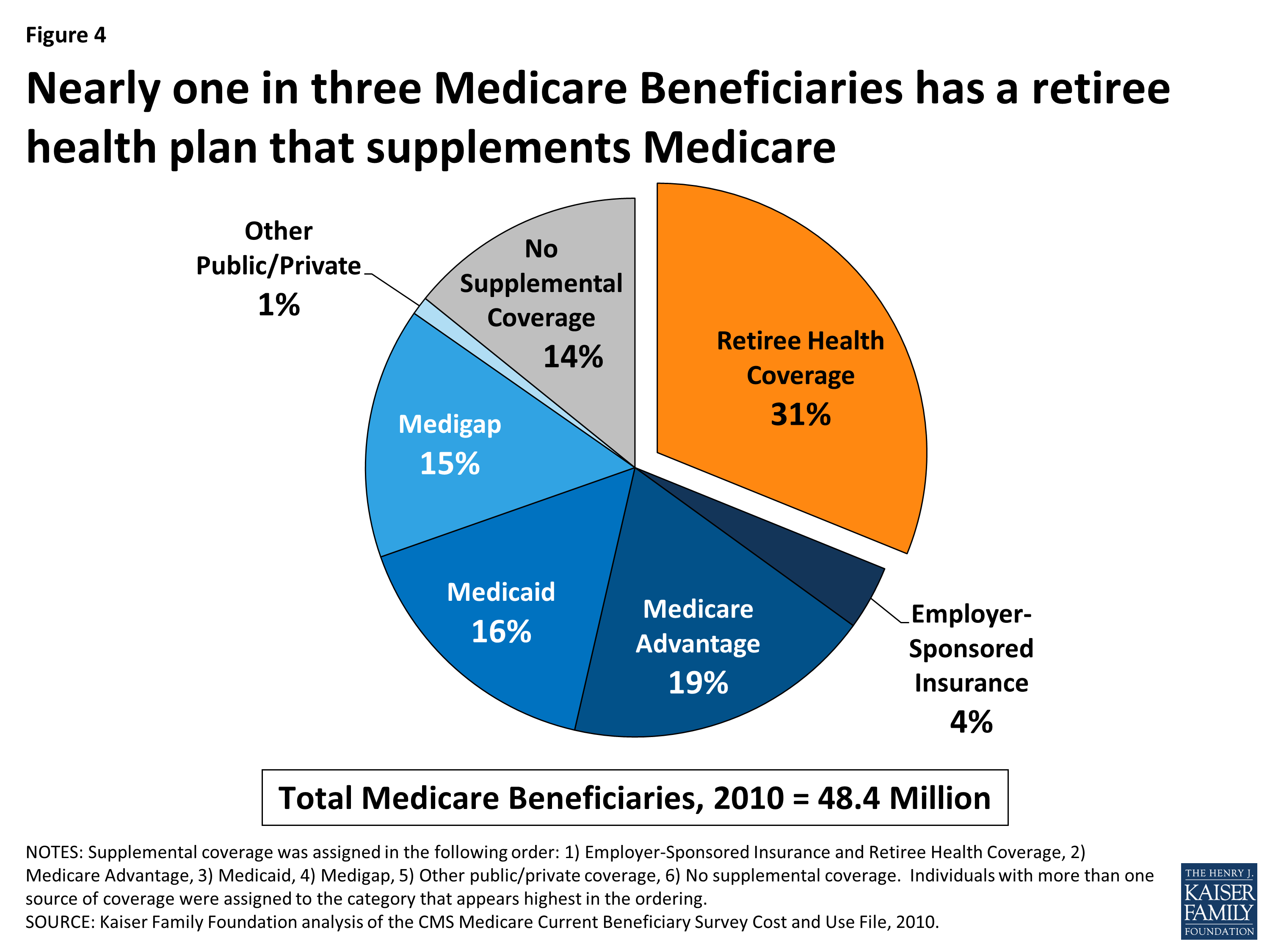

fulfill completely the demands of the without insurance (Medicare Advantage Agent). In 2017, healthcare facilities supplied$ 38.4 billion in unremunerated like patients. However, health centers likewise absorbed an additional $76.8 billion in underpayments from Medicare and Medicaid, and are encountering additional financing reductions with cuts to the Medicare and Medicaid disproportionate share hospital settlement programs. The Institute of Medication(IOM )Board on the Effects of Uninsurance launches a prolonged evaluation of proof that addresses the importance of wellness insurance policy protection with the publication of this record. Protection Matters is the very first in a series of six reports that will certainly be released over the following two years recording the fact and effects of having actually an estimated 40 million people in the United States without health and wellness insurance coverage. The Committee will look at whether, where, and exactly how the wellness and economic concerns of having a huge uninsured population are felt, taking a wide viewpoint and a multidisciplinary technique to these inquiries. To an excellent extent, the costs and repercussions of uninsured and unstably insured populaces are hidden and difficult to determine. The objective of this collection of researches is to redouble policy interest on a longstanding issue.

Things about Medicare Advantage Agent

Following the longest financial expansion in American background, in 1999, an approximated one out of every six Americans32 million grownups under the age of 65 and greater than 10 million childrenremains without insurance(Mills, 2000 ). This framework will direct the analysis in being successful records in the series and will certainly be customized to address each record's collection of topics.

The initial step in identifying and measuring the consequences of lacking medical insurance and visit this site of high without insurance prices at the area degree is to acknowledge that the objectives and constituencies served by medical insurance are multiple and distinctive. Ten percent of the population make up 70 percent of health and wellness care expenses, a connection that has stayed consistent over the previous three decades(Berk.

and Monheit, 2001). Thus health insurance coverage remains to serve the function of spreading out danger even as it increasingly funds regular treatment. From the viewpoint of health treatment service providers, insurance policy carried by their individuals helps safeguard an earnings stream, and areas take advantage of economically practical and secure healthcare specialists you can find out more and organizations. Federal government offers medical insurance to populaces whom the exclusive market might not offer effectively, such as disabled and senior persons, and populations whose access to health and wellness treatment is socially valued

, such as children and expecting females. The best ends of wellness insurance coverage for the individual and communities, including office communities of staff members and employers, are improved health outcomes and lifestyle. Without doubt, the intricacy of American healthcare financing mechanisms and the riches of sources of information include in the public's confusion and uncertainty concerning wellness insurance coverage stats and their interpretation. This report and thosethat will certainly adhere to goal to distill and provide in easily easy to understand terms the comprehensive study that bears on questions of health and wellness insurance policy coverage and its relevance. Fifty-seven percent of Americans questioned in 1999 believed that those without health insurance policy are"able to get the treatment they need from doctors and healthcare facilities" (Blendon et al., 1999, p. 207). In 1993, when national interest was focused on the issues of the uninsured and on pending healthtreatment regulation, just 43 percent of those questioned held this belief(Blendon et al., 1999 ). They also receive fewer preventive services and are much less most likely to have regular take care of persistent conditions such as high blood pressure and diabetes mellitus. Persistent illness can lead to costly and disabling problems if they are not well taken care of(Lurie et al., 1984; Lurie et al., 1986; Ayanian et al., 2000 ). One national survey asked greater than 3,400 grownups about 15 extremely serious or dark problems. Additional proof exists later in this phase in the discussion of insurance policy and accessibility to healthcare. Individuals without health insurance policy are young and healthy and choose to go without insurance coverage. Practically fifty percent(43 percent )of those evaluated in 2000 thought that people without health and wellness insurance are most likely to have health issue than individuals with insurance.